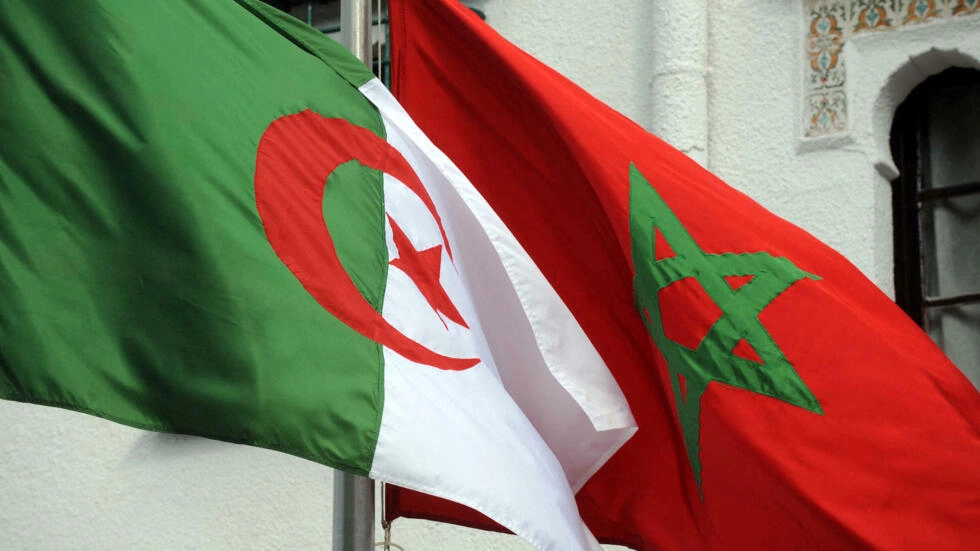

Algeria to press ahead with $3.5bn El Hamdania port & industrial zone to compete with Morocco’s Tanger Med project.

South Korea-based Yuhill-Yooshin and Algeria’s Laboratoire des études maritimes (LEM) completed a detailed plan at the end of December, and the project has now secured $900m worth of funding from the African Development Bank (AfDB), allowing the project to proceed. The AfDB loan will be repaid 20 years, with five years’ grace.

El Hamdania, which is located 70km west of Algiers, is to be developed in phases with eventual annual handling capacity of 6.3m TEU per year, spread over 23 berths. TEU measures a ship’s cargo carrying capacity, and the measurement is equivalent to 20 feet in length and 8 feet in height.

This would rank it second in Africa, after Tanger Med’s 9m TEU per year. The port is to be developed by China Harbour Engineering Company and China State Construction Engineering Corporation, which will take a joint 49% stake in the operating company, with the Algerian Port Authority taking 51%.

It has been reported in Algiers that a consortium of Chinese banks are to provide additional finance, although they have not yet been named. However, the involvement of Chinese firms in the scheme indicates that Chinese funding is likely.

Construction work is due to begin in March this year, with the first berths scheduled for completion in 2021.The ambition of competing with Morocco’s Tanger Med is a laudable.

The Moroccan project has managed to lure transhipment business away from ports in southern Europe, including Valencia and Algeciras in Spain and Gioia Tauro in Italy, while also encouraging export-driven firms to locate new factories in Morocco. By ensuring the same deepwater access and modern cargo handling equipment, Algiers is keen to follow the same model.

Private sector restrictions

However, it may not be quite as easy to copy Tanger Med’s success. There are still big restrictions on private sector participation in many sectors in Algeria, highlighted by the fact that the Algerian Port Authority will take a majority stake in El Hamdania’s operating company. Algeria has not thus far managed to attract anything like the same level of manufacturing investment as Morocco and Tunisia, and so has failed to take full advantage of its location close to the world’s biggest trading block, the European Union. Although two industrial zones next to the port will jointly provide 2,000 hectares of land, it may be difficult to attract tenants.

Algiers’ Arab socialist system is propped up by oil and gas income. Hydrocarbons still account for 94% of Algeria’s export revenues and 60% of state income. Lower oil and gas prices may have put a great deal of economic pressure on state finances, but the government is unlikely to relax state control of key sectors while the current political leaders remain in power and without a further sustained deterioration in hydrocarbon prices.

In the absence of a significantly more attractive investment regime, El Hamdania may fail to have the compound benefits for the rest of the economy that the government intends. However, the port could still become a magnet for the same kind of transhipment business as Tanger Med. China Cosco Shipping, China’s state owned shipping line, has suggested that it could make El Hamdania its hub in the western Mediterranean Sea.

Apart from Europe, the port will seek to attract transhipment business serving West Africa. In addition, the highway between the port and the southern border of Algeria is to be upgraded, enabling containers to be taken more quickly between El Hamdania and many parts of landlocked West Africa than they can be transported by sea.

Source: Algeria: $3.5bn El Hamdania port to compete with Tanger Med – African Business Magazine