Morocco has shown resilience in the face of the wave of successive events supposed to impact its economy and has managed to maintain an overall rating of “B3” in the new Country Risk Map 2023 from Allianz Trade, ranking it in the top 3 countries Africans.

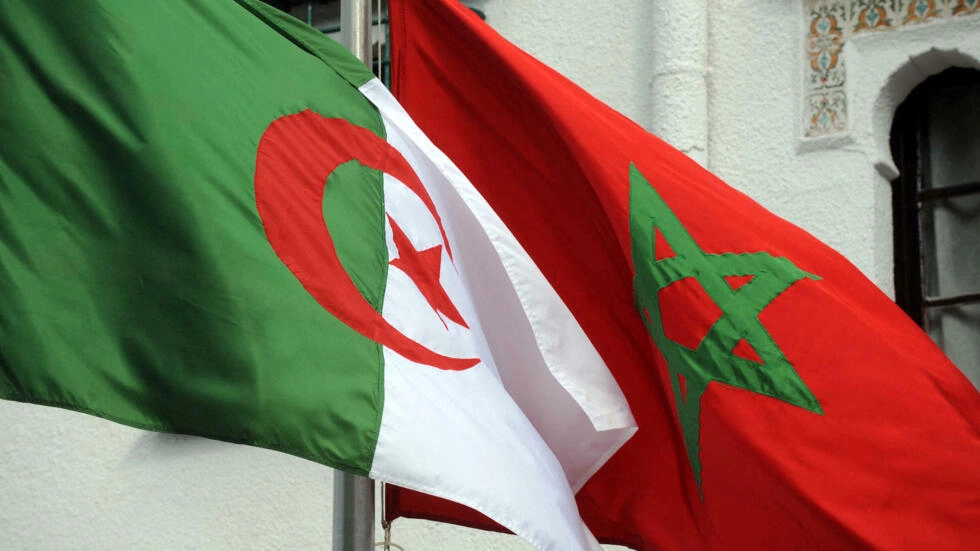

In a new economic study on the analysis of country risks in the first quarter of 2023, Allianz Trade granted a “B3” (significant risk for business) to Morocco, one of the best ratings in Africa, allowing it to exceed those of South Africa (C3), Algeria (C3), Kenya (C3), Ghana (C4), Nigeria (D3), Egypt (D4) and Ethiopia (D4).

According to the Allianz risk map, Morocco is in the top 3 of African countries, behind Botswana (BB1) and shares the same rank as Mauritius (B3). It should be noted that the group assesses the countries concerned and awards ratings according to specific criteria, namely macroeconomic imbalances, the business environment, political stability and commercial and financial risks. The country rating is a mid-term assessment ranging from AA to D (highest risk).

According to Allianz analysis, the Moroccan economy is expected to show annual growth of around +3% in 2023, reflecting weak demand growth in its main trading partners, notably the eurozone. The export of agricultural products, phosphates and manufactured goods will reduce the external deficit, while food-related inflationary pressures should normalize, the group adds.

It recalls all the events that have hit the Kingdom hard, including drought, water stress, annual inflation which reached 6.6% in 2022, food prices increasing by 11.0% and non-food prices by 3.9%, mainly driven by transport prices, which increased by 12.2% in 2022.

However, the forecast of an acceleration of economic growth in 2023 is mainly based on expectations of a recovery of the agricultural sector, but the climatic conditions, the scarcity of water and the need to prioritize domestic consumption and production Domestic electricity shortages will weigh on harvests and may retard this growth, although progress in liberalizing the electricity market should accelerate the transition to renewable energy.

Rainfall levels in December were 24% lower than the 10-year average and 8.4% lower than the same period in 2021, the report said.

Furthermore, the other risk weighing on the outlook is the resurgence of the price of the raw materials that Morocco imports. The economy is highly dependent on energy imports and therefore on the volatility of oil and gas prices.

Last year, the energy bill more than doubled due to rising fuel prices. The government plans to mobilize to increase fuel storage capacity by the end of 2023.

Tourism, remittances and exports remain the Kingdom’s main sources of hard currency, says Allianz.

In addition, steps taken to reform state-owned enterprises, as well as the activation of the Mohammed VI Fund and the implementation of the new Investment Charter, are widely seen as potential catalysts for foreign direct investment, the group continues.